Solution Manual for Intermediate Accounting Volume 2 8th Edition Thomas H. Beechy ISBN: 9780071338820

Course:

Intermediate Accounting

Institution:

Intermediate Accounting

Solution Manual for Intermediate Accounting Volume 2 8th Edition Thomas H. Beechy ISBN: 9780071338820 Case 12-1 Winter Fun Incorporated 12-2 Prescriptions Depot Limited 12-3 Camani Corporation Suggested Time Technical Review TR12-1 Financial liabilit...

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Overview

This material encourages active engagement through solution walkthroughs that reinforce both theory and application. Rather than passively reading, you're constantly interacting with the content through problem-solving. This active learning approach makes study sessions more dynamic and information more memorable. Many learners find they retain knowledge better when they've worked through problems rather than just reviewed notes.

Who Is This For?

Created for exam takers seeking maximum exposure to typical Testbank questions, rationales, and scenarios. People often use it to test their readiness before the actual exam. The complete coverage ensures thorough preparation. Built for independent learners, study groups, and classroom instructors who require reliable exam-prep content in Intermediate Accounting. Teachers often incorporate these materials into their lesson plans. The consistent quality makes it a trusted resource semester after semester.

Related Keywords

Detailed Study Description

Frequently Asked Questions

Document Information

| Uploaded on: | November 1, 2025 |

| Last updated: | November 17, 2025 |

| Number of pages: | 892 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | Solution Manual for Intermediate Accounting Volume 2 8th Edition Thomas H. Beechy ISBN: 9780071338820 Case 12-1 Winter Fun Incorporated 12-2 Prescriptions Depot Limited 12-3 Camani Corporation Suggested Time Technical Review TR12-1 Financial liabilities and provisions (IFRS) ...... 10 TR12-2 Financial liabilities and provisions (ASPE)..... 10 TR12-3 Provision, measurement................................... 10 TR12-4 Guarantee ......................................................... 10 TR12-5 Provision, warranty.......................................... 5 TR12-6 Foreign currency .............................................. 5 TR12-7 Note payable .................................................... 5 TR12-8 Discounting, note payable................................ 10 TR12-9 Discounting, provision..................................... 10 TR12-10 Classification, liabilities................................... 10 Assignment A12-1 Financial versus non-financial liabilities……. 10 A12-2 Common financial liabilities………………… 10 A12-3 Common financial liabilities............................ 10 A12-4 Common financial liabilities: taxes ................. 20 A12-5 Common financial liabilities: taxes ................ 20 A12-6 Foreign currency payables……………………. 10 A12-7 Foreign currency payables ............................... 10 A12-8 Common financial liabilities and foreign currency 25 A12-9 Provisions......................................................... 20 A12-10 Provisions ........................................................ 20 A12-11 Provisions......................................................... 20 A12-12 Provision measurement.................................... 15 A12-13 Provision measurement.................................... 15 A12-14 Provisions; compensated absences…………... 15 A12-15 Provisions; compensated absences .................. 15 A12-16 Provisions; warranty ........................................ 15 A12-17 Provisions; warranty ....................................... 20 A12-18 Provisions; warranty ....................................... 25 A12-19 Discounting; no-interest note........................... 15 A12-20 Discounting; low-interest note ........................ 20 |

Seller Information

AdelineJean

User Reviews (0)

Exam (Elaborations)

$19.50

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$19.50

| 0 sold

Discover More resources

Inside The Document

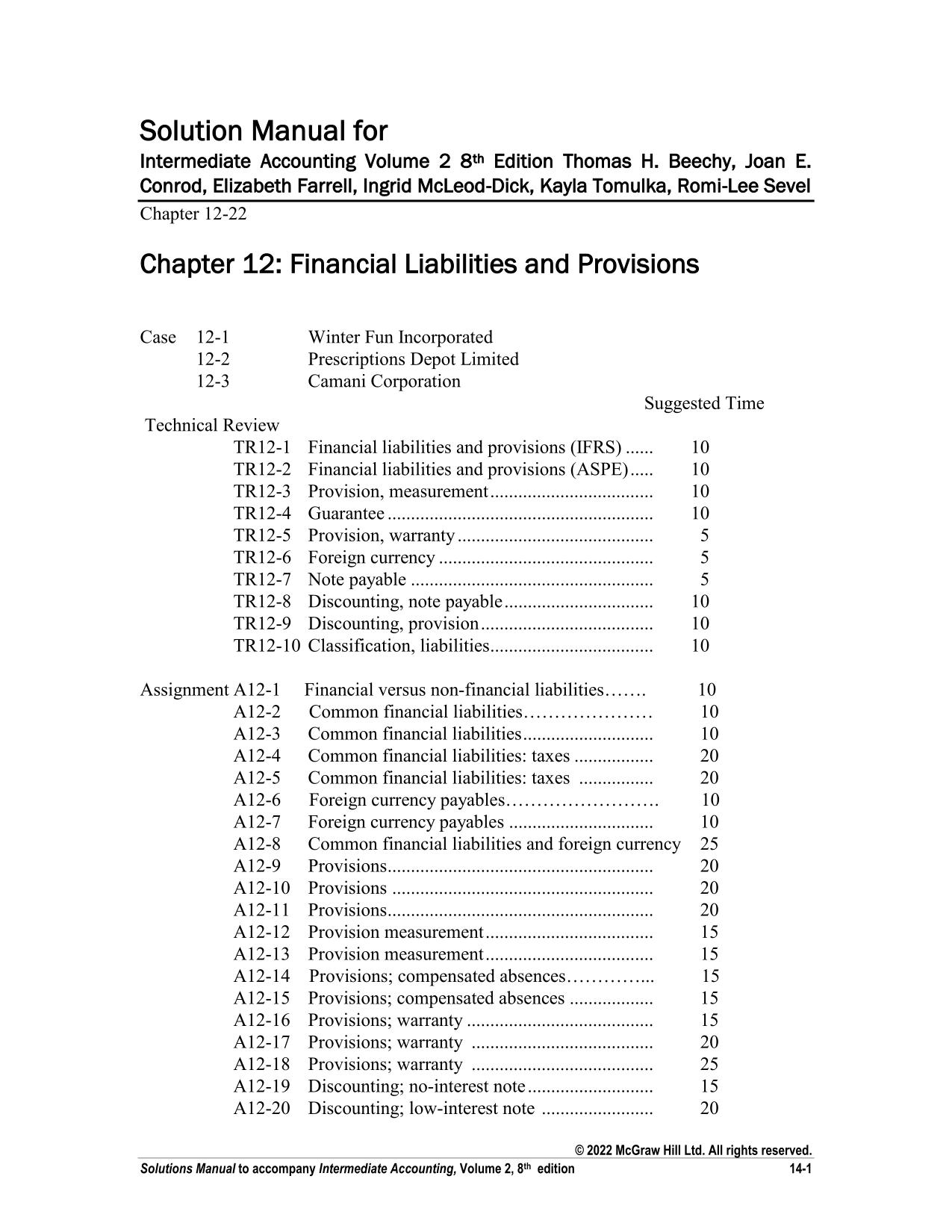

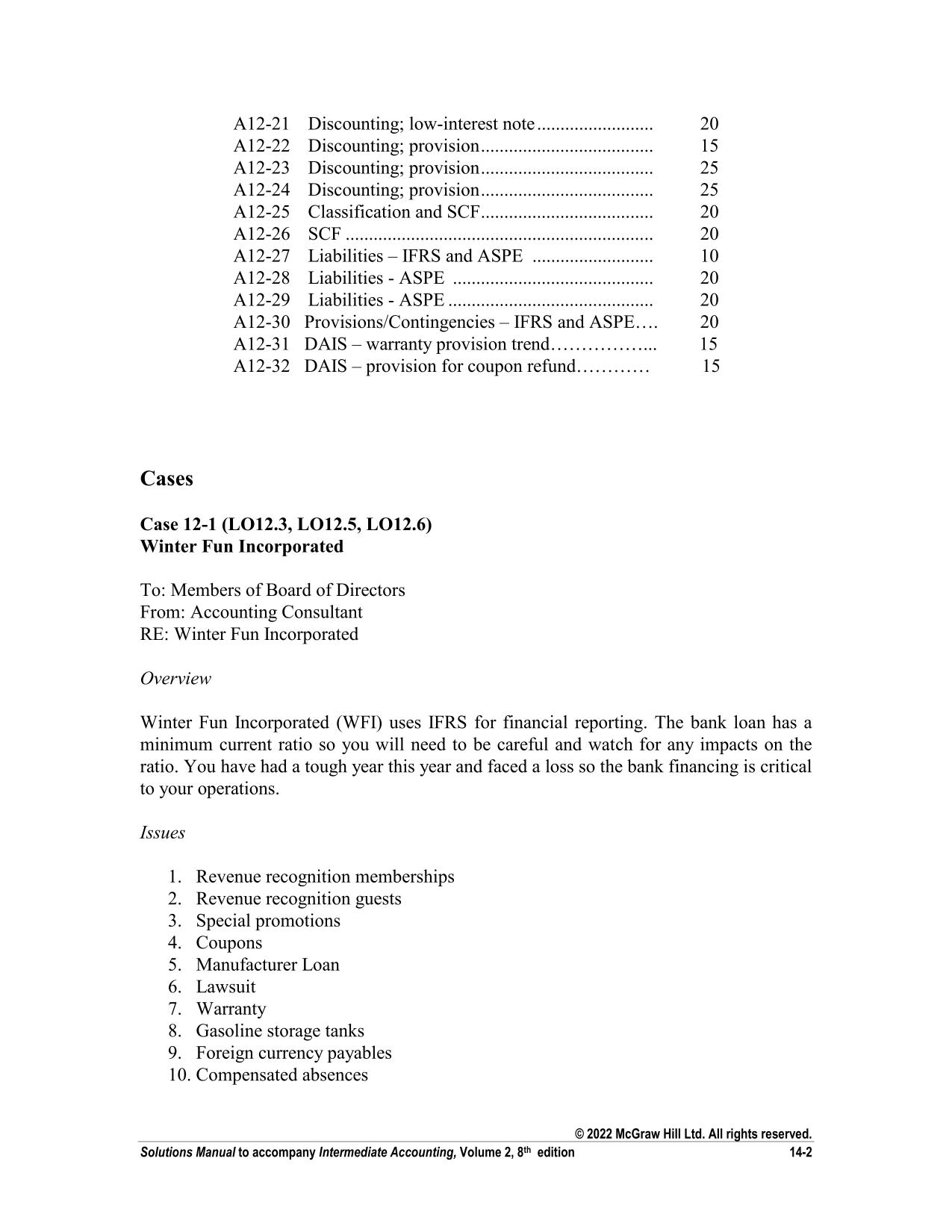

Solution Manual for Intermediate Accounting Volume 2 8 th Edition Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel Chapter 12-22 Chapter 12: Financial Liabilities and Provisions Case 12-1 12-2 12-3 Winter Fun Incorporated Prescriptions Depot Limited Camani Corporation Suggested Time Technical Review TR12-1 Financial liabilities and provisions (IFRS) ...... TR12-2 Financial liabilities and provisions (ASPE) ..... TR12-3 Provision, measurement ................................... TR12-4 Guarantee ......................................................... TR12-5 Provision, warranty .......................................... TR12-6 Foreign currency .............................................. TR12-7 Note payable .................................................... TR12-8 Discounting, note payable ................................ TR12-9 Discounting, provision ..................................... TR12-10 Classification, liabilities................................... Assignment A12-1 A12-2 A12-3 A12-4 A12-5 A12-6 A12-7 A12-8 A12-9 A12-10 A12-11 A12-12 A12-13 A12-14 A12-15 A12-16 A12-17 A12-18 A12-19 A12-20 10 10 10 10 5 5 5 10 10 10 Financial versus non-financial liabilities……. 10 Common financial liabilities………………… 10 Common financial liabilities ............................ 10 Common financial liabilities: taxes ................. 20 Common financial liabilities: taxes ................ 20 Foreign currency payables……………………. 10 Foreign currency payables ............................... 10 Common financial liabilities and foreign currency 25 Provisions......................................................... 20 Provisions ........................................................ 20 Provisions......................................................... 20 Provision measurement .................................... 15 Provision measurement .................................... 15 Provisions; compensated absences…………... 15 Provisions; compensated absences .................. 15 Provisions; warranty ........................................ 15 Provisions; warranty ....................................... 20 Provisions; warranty ....................................... 25 Discounting; no-interest note ........................... 15 Discounting; low-interest note ........................ 20 Solutions Manual to accompany Intermediate Accounting, Volume 2, 8th edition © 2022 McGraw Hill Ltd. All rights reserved. 14-1 A12-21 A12-22 A12-23 A12-24 A12-25 A12-26 A12-27 A12-28 A12-29 A12-30 A12-31 A12-32 Discounting; low-interest note ......................... Discounting; provision ..................................... Discounting; provision ..................................... Discounting; provision ..................................... Classification and SCF..................................... SCF .................................................................. Liabilities – IFRS and ASPE .......................... Liabilities - ASPE ........................................... Liabilities - ASPE ............................................ Provisions/Contingencies – IFRS and ASPE…. DAIS – warranty provision trend……………... DAIS – provision for coupon refund………… 20 15 25 25 20 20 10 20 20 20 15 15 Cases Case 12-1 (LO12.3, LO12.5, LO12.6) Winter Fun Incorporated To: Members of Board of Directors From: Accounting Consultant RE: Winter Fun Incorporated Overview Winter Fun Incorporated (WFI) uses IFRS for financial reporting. The bank loan has a minimum current ratio so you will need to be careful and watch for any impacts on the ratio. You have had a tough year this year and faced a loss so the bank financing is critical to your operations. Issues 1. Revenue recognition memberships 2. Revenue recognition guests 3. Special promotions 4. Coupons 5. Manufacturer Loan 6. Lawsuit 7. Warranty 8. Gasoline storage tanks 9. Foreign currency payables 10. Compensated absences Solutions Manual to accompany Intermediate Accounting, Volume 2, 8th edition © 2022 McGraw Hill Ltd. All rights reserved. 14-2 Analysis and Recommendations 1. Revenue recognition memberships Following the 5 step IFRS model: Initiation fee Step 1: The contract with the customer is for the membership in the club. This would be a written agreement between the member and WFI. Step 2: There is one performance obligation, the promised service is membership in the ski club. There is no transfer of the service until the membership is provided. Step 3: The contract price is $10,000. The non-refundable deposit is an advance payment towards this initiation fee and is part of the overall transaction price. Step 4: No allocation since there is only one performance obligation. Step 5: The performance obligation for the initiation fee is satisfied over the period of time that the member belongs to the club. The $10,000 would be recognized over the average period a member belongs. There should be enough historical data available to come up with a reasonable estimate. There would be no cash collection risk since the amount is paid upfront. Annual fee Step 1: The annual fee is a written agreement between the member and WFI. Step 2: There is again one performance obligation, the service for this year. Step 3: The fee of $2,000 is the total contract price and is received in 20X5 for the 20X6 ski season. This would be unearned revenue when received. Step 4: There is no allocation since there is only one performance obligation. Step 5: Assuming the ski season goes from Dec 1 until March 31 $500 would be recognized in 20X5 and the remainder in 20X6 which would be the period in which the service is performed. There would be no cash collection risk since the amount is paid upfront. 2. Revenue recognition guests Following the 5 step IFRS model: Step 1: The contract with the guest is the written contract when they receive the ticket to ski, not when the reservation is made since this reservation could be cancelled. Solutions Manual to accompany Intermediate Accounting, Volume 2, 8th edition © 2022 McGraw Hill Ltd. All rights reserved. 14-3 Step 2: The performance obligation is the right to ski that day. Step 3: The overall contract price is the price of the ski ticket. Step 4: There is no allocation since there is only one performance obligation. Step 5: The performance would be the right to ski on that day. There is no cash collection risk since the guest pays by credit card when they purchase the ticket. 3. Special promotions Following the 5 step IFRS model: Step 1: The contract with the customer is the written contract when they receive the ticket and the right to a future lesson. Step 2: There are two separate performance obligations the right to ski and the right to the lesson. Step 3: The total contract price is $100. Step 4: This price would need to be allocated to the two separate performance obligations based on their relative fair value. Fair value ski pass Fair value lesson Total fair value 80 = 61.5% x 100 = $61.50 50 = 38.5% x 100 = $38.50 130 Step 5: The $61.50 allocated to the performance obligation for the ski pass would be satisfied on the day that they ski. For the $38.50, the performance obligation would be satisfied on the day they take the lesson. There would be no cash collection risk assuming a credit card is used to purchase the special pass. 4. Coupons It must be determined if an economic loss would occur for the coupons. The coupons are for $5 and the price of a ski pass is $80. This is a minor amount compared to the price of the ski pass so WFI would still be selling the ski pass at a profit. Therefore, the coupons should only be recognized as a cost when they are redeemed. 5. Manufacturer Loan The manufacturer of the ski lift has provided a 0% interest loan. This is often referred to as a dealer loan. The loan is either measured in FVTPL or other liabilities. Most liabilities Solutions Manual to accompany Intermediate Accounting, Volume 2, 8th edition © 2022 McGraw Hill Ltd. All rights reserved. 14-4

CourseHero & Studypool Unlocks

Get Unlocked CourseHero and Studypool documents files instantly to your email, simply by pasting your link and clicking "Unlock Now". Learn more on how to unlock here.