Solution manual for principles of corporate finance 14th edition by richard Brealey ISBN-13. 978-0077316457

Course:

Corporate Finance

Institution:

Corporate Finance

Solution manual for principles of corporate finance 14th edition by richard Brealey, stewart myers, franklin allen ISBN-13. 978-0077316457

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Document Information

| Uploaded on: | April 24, 2025 |

| Last updated: | May 12, 2025 |

| Number of pages: | 391 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | Solution manual for principles of corporate finance 14th edition by richard Brealey, stewart myers, franklin allen ISBN-13. 978-0077316457 |

Seller Information

AdelineJean

User Reviews (0)

Exam (Elaborations)

$14.00

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$14.00

| 0 sold

Discover More resources

Content Preview

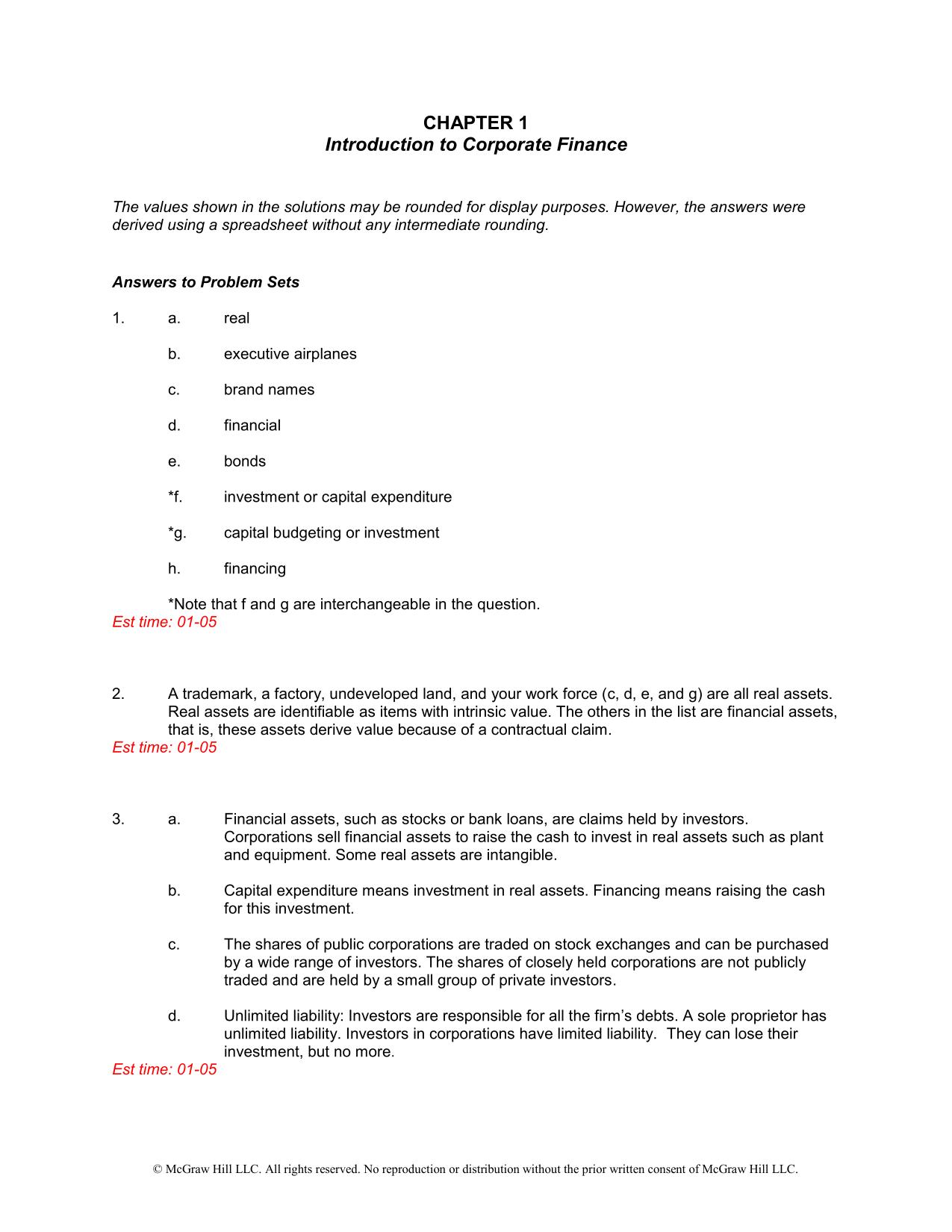

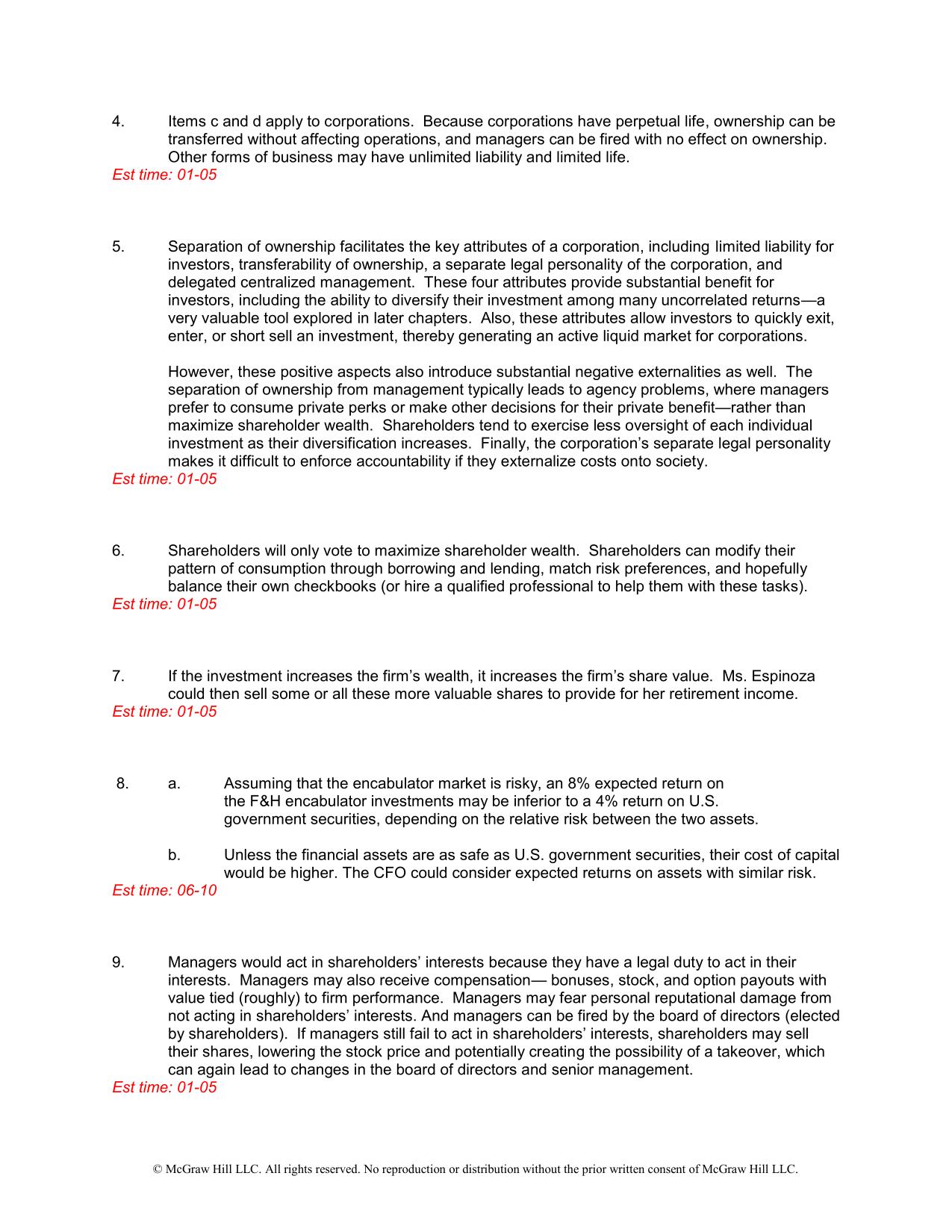

CHAPTER 1 Introduction to Corporate Finance The values shown in the solutions may be rounded for display purposes. However, the answers were derived using a spreadsheet without any intermediate rounding. Answers to Problem Sets 1. a. real b. executive airplanes c. brand names d. financial e. bonds *f. investment or capital expenditure *g. capital budgeting or investment h. financing *Note that f and g are interchangeable in the question. Est time: 01-05 2. A trademark, a factory, undeveloped land, and your work force (c, d, e, and g) are all real assets. Real assets are identifiable as items with intrinsic value. The others in the list are financial assets, that is, these assets derive value because of a contractual claim. Est time: 01-05 3. a. Financial assets, such as stocks or bank loans, are claims held by investors. Corporations sell financial assets to raise the cash to invest in real assets such as plant and equipment. Some real assets are intangible. b. Capital expenditure means investment in real assets. Financing means raising the cash for this investment. c. The shares of public corporations are traded on stock exchanges and can be purchased by a wide range of investors. The shares of closely held corporations are not publicly traded and are held by a small group of private investors. d. Unlimited liability: Investors are responsible for all the firm‘s debts. A sole proprietor has unlimited liability. Investors in corporations have limited liability. They can lose their investment, but no more. Est time: 01-05 © McGraw Hill LLC. All rights reserved. No reproduction or distribution without the prior written consent of McGraw Hill LLC.