TEST BANK For Louwers, Auditing and Assurance Services 9th Edition, by Louwers, Bagley, Blay, Strawser, and Thibodeau, Verified Chapters 1 - 12

Course:

Auditing

Institution:

Auditing

TEST BANK For Louwers, Auditing and Assurance Services 9th Edition, by Louwers, Bagley, Blay, Strawser, and Thibodeau, Verified Chapters 1 - 12

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Overview

The document highlights key principles that repeatedly appear on exam sessions, reinforcing crucial knowledge. You're always focusing on high-yield content that has the biggest impact on your score. This strategic emphasis is perfect for busy learners who need to make the most of limited study time. Many students find this focus helps them prioritize their efforts where they'll get the greatest return.

Who Is This For?

Built for independent learners, study groups, and classroom instructors who require reliable exam-prep content in Auditing. Teachers often incorporate these materials into their lesson plans. The consistent quality makes it a trusted resource semester after semester.

Related Keywords

Detailed Study Description

Frequently Asked Questions

Document Information

| Uploaded on: | November 1, 2025 |

| Last updated: | November 17, 2025 |

| Number of pages: | 459 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | TEST BANK For Louwers, Auditing and Assurance Services 9th Edition, by Louwers, Bagley, Blay, Strawser, and Thibodeau, Verified Chapters 1 - 12 |

Seller Information

AdelineJean

User Reviews (0)

Exam (Elaborations)

$18.00

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$18.00

| 0 sold

Discover More resources

Inside The Document

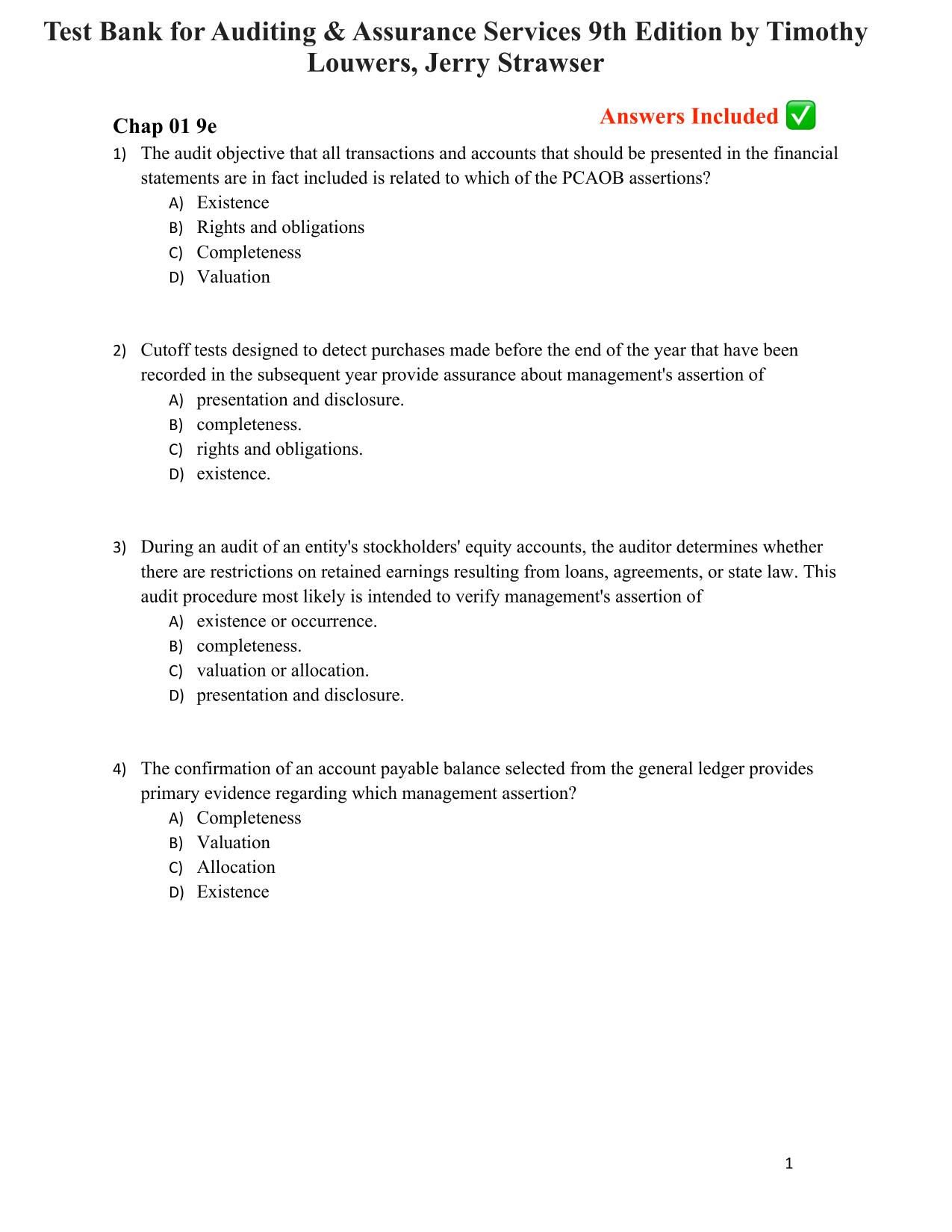

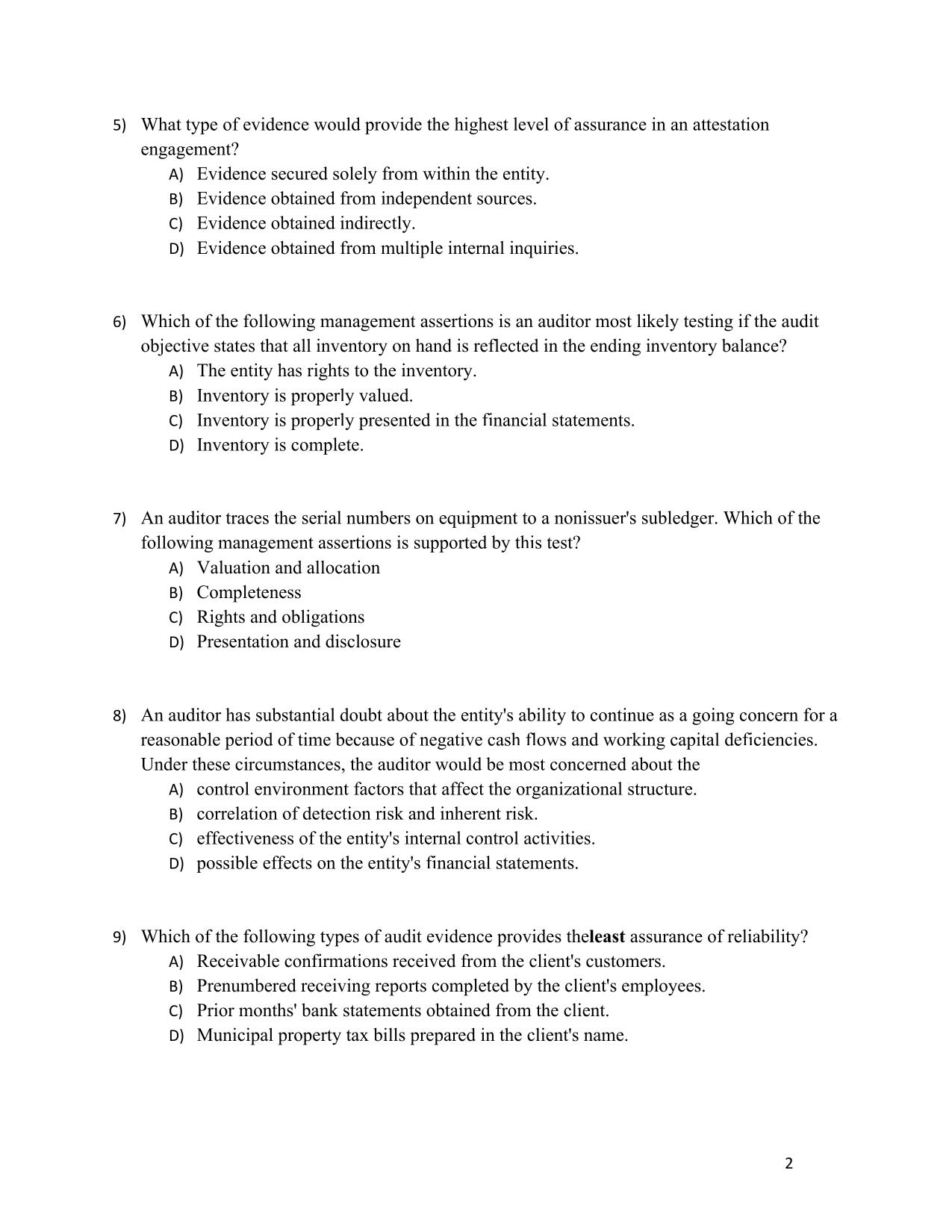

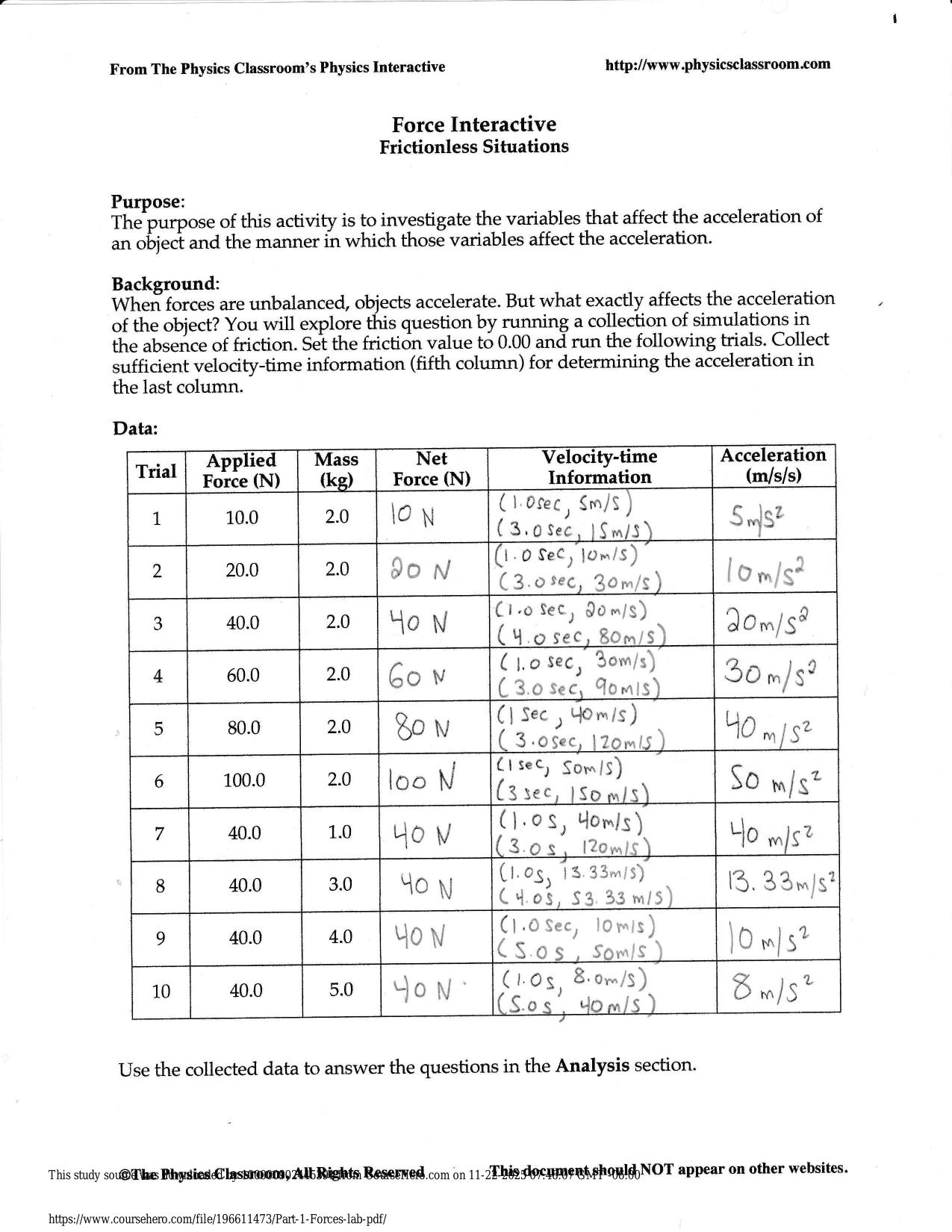

Test Bank for Auditing & Assurance Services 9th Edition by Timothy Louwers, Jerry Strawser Chap 01 9e Answers Included ✅ 1) The audit objective that all transactions and accounts that should be presented in the financial statements are in fact included is related to which of the PCAOB assertions? A) Existence B) Rights and obligations C) Completeness D) Valuation 2) Cutoff tests designed to detect purchases made before the end of the year that have been recorded in the subsequent year provide assurance about management's assertion of A) presentation and disclosure. B) completeness. C) rights and obligations. D) existence. 3) During an audit of an entity's stockholders' equity accounts, the auditor determines whether there are restrictions on retained earnings resulting from loans, agreements, or state law. This audit procedure most likely is intended to verify management's assertion of A) existence or occurrence. B) completeness. C) valuation or allocation. D) presentation and disclosure. 4) The confirmation of an account payable balance selected from the general ledger provides primary evidence regarding which management assertion? A) Completeness B) Valuation C) Allocation D) Existence 1 5) What type of evidence would provide the highest level of assurance in an attestation engagement? A) Evidence secured solely from within the entity. B) Evidence obtained from independent sources. C) Evidence obtained indirectly. D) Evidence obtained from multiple internal inquiries. 6) Which of the following management assertions is an auditor most likely testing if the audit objective states that all inventory on hand is reflected in the ending inventory balance? A) The entity has rights to the inventory. B) Inventory is properly valued. C) Inventory is properly presented in the financial statements. D) Inventory is complete. 7) An auditor traces the serial numbers on equipment to a nonissuer's subledger. Which of the following management assertions is supported by this test? A) Valuation and allocation B) Completeness C) Rights and obligations D) Presentation and disclosure 8) An auditor has substantial doubt about the entity's ability to continue as a going concern for a reasonable period of time because of negative cash flows and working capital deficiencies. Under these circumstances, the auditor would be most concerned about the A) control environment factors that affect the organizational structure. B) correlation of detection risk and inherent risk. C) effectiveness of the entity's internal control activities. D) possible effects on the entity's financial statements. 9) Which of the following types of audit evidence provides theleast assurance of reliability? A) Receivable confirmations received from the client's customers. B) Prenumbered receiving reports completed by the client's employees. C) Prior months' bank statements obtained from the client. D) Municipal property tax bills prepared in the client's name. 2 10) Which of the following is a management assertion regarding account balances at the period end? A) Transactions and events that have been recorded have occurred and pertain to the entity. B) Transactions and events have been recorded in the proper accounts. C) The entity holds or controls the rights to assets, and liabilities are obligations of the entity. D) Amounts and other data related to the transactions and events have been recorded appropriately. 11) A practitioner is engaged to express an opinion on management's assertion that the square footage of a warehouse offered for sale is 150,000 square feet. The practitioner should refer to which of the following sources for professional guidance? A) Statement of Auditing Standards. B) Statements on Standards for Attestation Engagements. C) Statements on Standards for Accounting and Review Services. D) Statements on Standards for Consulting Services. 12) In auditing the long-term debt account, an auditor's procedures most likely would focus primarily on management's assertion of A) existence. B) completeness. C) allocation. D) rights and obligations. 13) An auditor selected items for test counts from the client's warehouse during the physical inventory observation. The auditor then traced these test counts into the detailed inventory listing that ultimately agreed to the financial statements. This procedure most likely provided evidence concerning management's assertion of A) completeness. B) valuation. C) presentation and disclosure. D) existence. E) rights and obligations. 3 14) An auditor selected items from the client's detailed inventory listing (that agreed to the financial statements). During the physical inventory observation, the auditor then found each item selected and counted the number of units on hand. Assuming that the amount on hand was the same as the amount in the client's detailed inventory listing, this procedure most likely would provide evidence concerning management's assertion of A) completeness. B) valuation. C) presentation and disclosure. D) existence. E) rights and obligations. 15) According to PCAOB Auditing Standard No. 2201 ( AS 2201), the auditor should identify significant accounts and disclosures and their relevant assertions. Which of the following financial statement assertions is not explicitly identified in AS 2201? A) Completeness B) Valuation or allocation C) Accuracy D) Existence or occurrence E) All of these are assertions identified in AS 2201. 16) When testing the completeness assertion for a liability account, an auditor ordinarily works from the A) financial statements to the potentially unrecorded items. B) potentially unrecorded items to the financial statements. C) accounting records to the supporting evidence. D) trial balance to the subsidiary ledger. 17) If an auditor is performing procedures related to the information that is contained in the client's pension footnote, he/she is most likely to obtain evidence concerning management's assertion about A) rights and obligations. B) existence. C) valuation. D) presentation and disclosure. 4

CourseHero & Studypool Unlocks

Get Unlocked CourseHero and Studypool documents files instantly to your email, simply by pasting your link and clicking "Unlock Now". Learn more on how to unlock here.