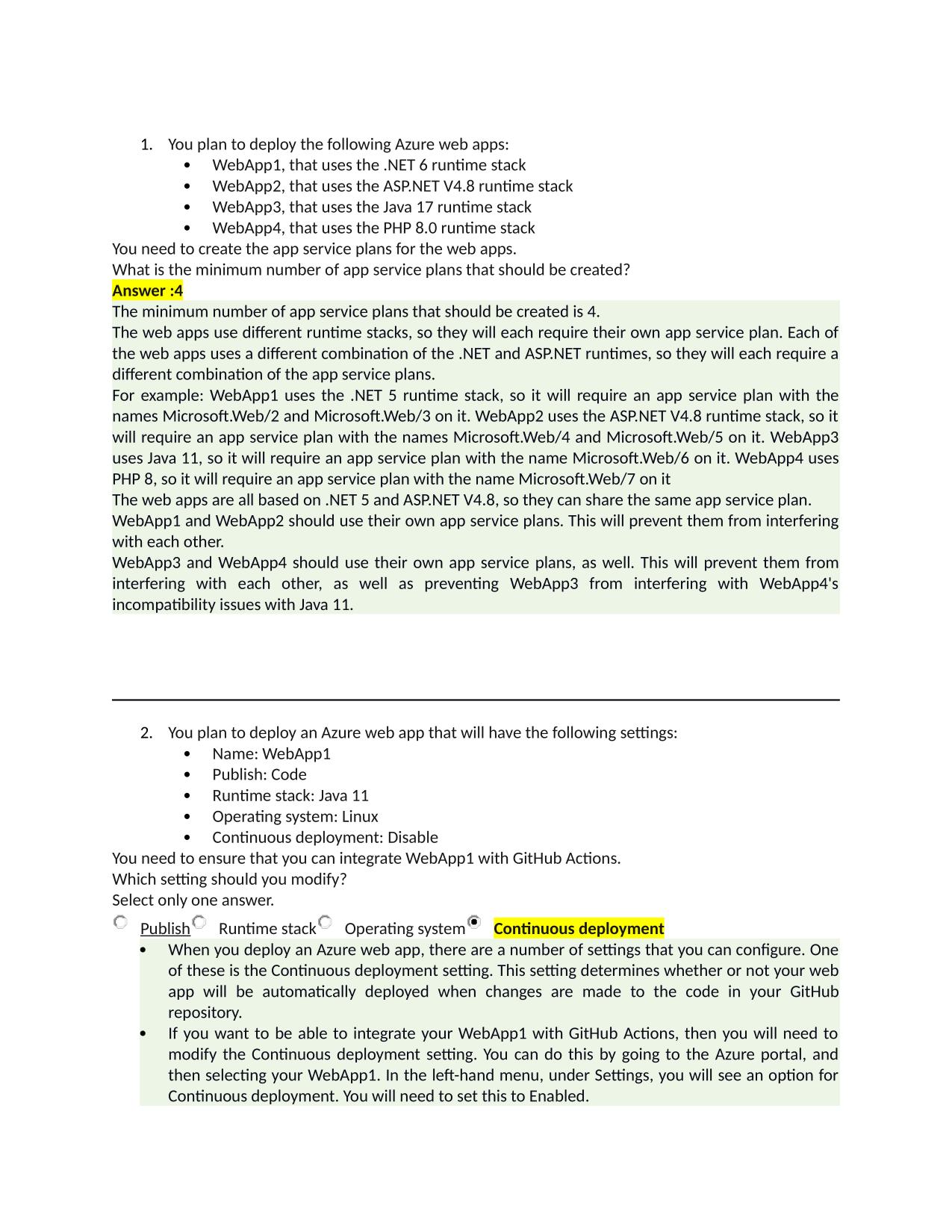

FPQP EXAM ACTUAL 2025/2026 (FINANCIAL PARAPLANNER QUALIFIED PROFESSIONAL) QUESTIONS AND 100% CORRECT ANSWERS

Course:

FPQP

Institution:

FPQP

FPQP EXAM ACTUAL 2025/2026 (FINANCIAL PARAPLANNER QUALIFIED PROFESSIONAL) QUESTIONS AND 100% CORRECT ANSWERS Comprehensive Financial Plan - Answer -covers almost all aspects of a personal's financial situation (including risk mamagenet, investment pl...

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Overview

Expect a mix of multiple-choice and contextual items that test application, analysis and core knowledge areas. This variety keeps your study sessions fresh and engaging, much like the actual exam you'll be facing. Many learners mention how the scenario questions in particular help them connect dry textbook concepts to practical situations they might encounter in their careers. The different formats ensure you're prepared for whatever curveballs the exam might throw your way. The document introduces learners to the pacing, logic, and question flow commonly seen in FPQP ACTUAL / (FINANCIAL PARAPLANNER QUALIFIED PROFESSIONAL) AND 100% CORRECT assessments. You'll develop a natural rhythm for working through questions efficiently without rushing. Many students find their timing improves dramatically after practicing with these materials under simulated exam conditions. That comfort with the pace prevents panic and helps you maintain focus throughout the entire test.

Who Is This For?

Anyone preparing for FPQP ACTUAL / (FINANCIAL PARAPLANNER QUALIFIED PROFESSIONAL) AND 100% CORRECT, including adult learners and working professionals, will benefit from the organized layout of this resource. Many users report feeling better prepared after working through the materials. The logical progression builds understanding step by step.

Related Keywords

Detailed Study Description

Frequently Asked Questions

Document Information

| Uploaded on: | October 31, 2025 |

| Last updated: | November 17, 2025 |

| Number of pages: | 17 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | FPQP EXAM ACTUAL 2025/2026 (FINANCIAL PARAPLANNER QUALIFIED PROFESSIONAL) QUESTIONS AND 100% CORRECT ANSWERS Comprehensive Financial Plan - Answer -covers almost all aspects of a personal's financial situation (including risk mamagenet, investment planning, tax, retirement, and estate planning) Targeted Financial Plan - Answer -focus on a segment of individual's objectives. (ex - first home, elderly care, reducing tax burden) Goals should be... |

Seller Information

AdelineJean

User Reviews (0)

Exam (Elaborations)

$9.50

Bundle Deal! Get all 3 docs for just $14.00

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$9.50

| 0 sold

Discover More resources

Available in a Bundle

Inside The Document

FPQP EXAM ACTUAL 2025/2026 (FINANCIAL PARAPLANNER QUALIFIED PROFESSIONAL) QUESTIONS AND 100% CORRECT ANSWERS Comprehensive Financial Plan - Answer -covers almost all aspects of a personal's financial situation (including risk mamagenet, investment planning, tax, retirement, and estate planning) Targeted Financial Plan - Answer -focus on a segment of individual's objectives. (ex - first home, elderly care, reducing tax burden) Goals should be... - Answer -defined or definite Steps to setting financial goal - Answer -1. Purpose, 2. Timeframe, 3. Amount ("PTA") Personal financial planning is continuous or noncontinuous? - Answer -Continuous 7 Steps of Financial Planning Process: - Answer -1. Understanding client's personal and financial circumstances. 2. Identifying and selecting goals. 3. Analyzing the client's current course of action and potential alternatre course(s). 4. Devleoping the financial planning recommendations. 5. Presenting the financial planning recommendations. 6. Implementing the financial planning recommendations. Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com 7. Monitoring process and updating. Two types of information: (Step 1 - Understanding client's personal and financial circumstances) - Answer -1. Quantitative - "names and numbers" family profile, assets and liability, cash inflows/outflaws, insurance policy info, employee/pension plan, tax returns, retirement benefits 2. Qualititative - "lifestyle info" goals/objectives, health status, interests/hobbies, risk-tolerance level, changes in lifestyle, estate planning issues, money values, family relationships, planning assumptions "SWOT" Approach (Step 3 - analyze and evaluate) - Answer -SWOT = Strenghs, Weaknesses, Opportunities, Threats Existing conditions are reviewed to identify strengths and weakenesses in client's total current financial situation. Identifying existing or potential problems that could impact the client's ability to achieve objectives. Emergency fund should be how much? - Answer -3-6 months expenses in emergency fund. Developing a plan means... (Step 4 - Reccommdations) - Answer -the planner determines the appropriate asset categories for the client's objective, time horizon, etc. What duty is required of a financial planner? - Answer -Fiduciary Duty = keep client's best interest over your's or your firm's. Cash Flow Statement Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com

CourseHero & Studypool Unlocks

Get Unlocked CourseHero and Studypool documents files instantly to your email, simply by pasting your link and clicking "Unlock Now". Learn more on how to unlock here.