IACCP (QE) EXAM ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS

Course:

IACCP

Institution:

IACCP

IACCP (QE) EXAM ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Which THREE persons or firms may be excluded from having to register under the Investment Advisers Act of 1940? (Choose three.) A. Accountants whose advisory services pertain solely ...

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Overview

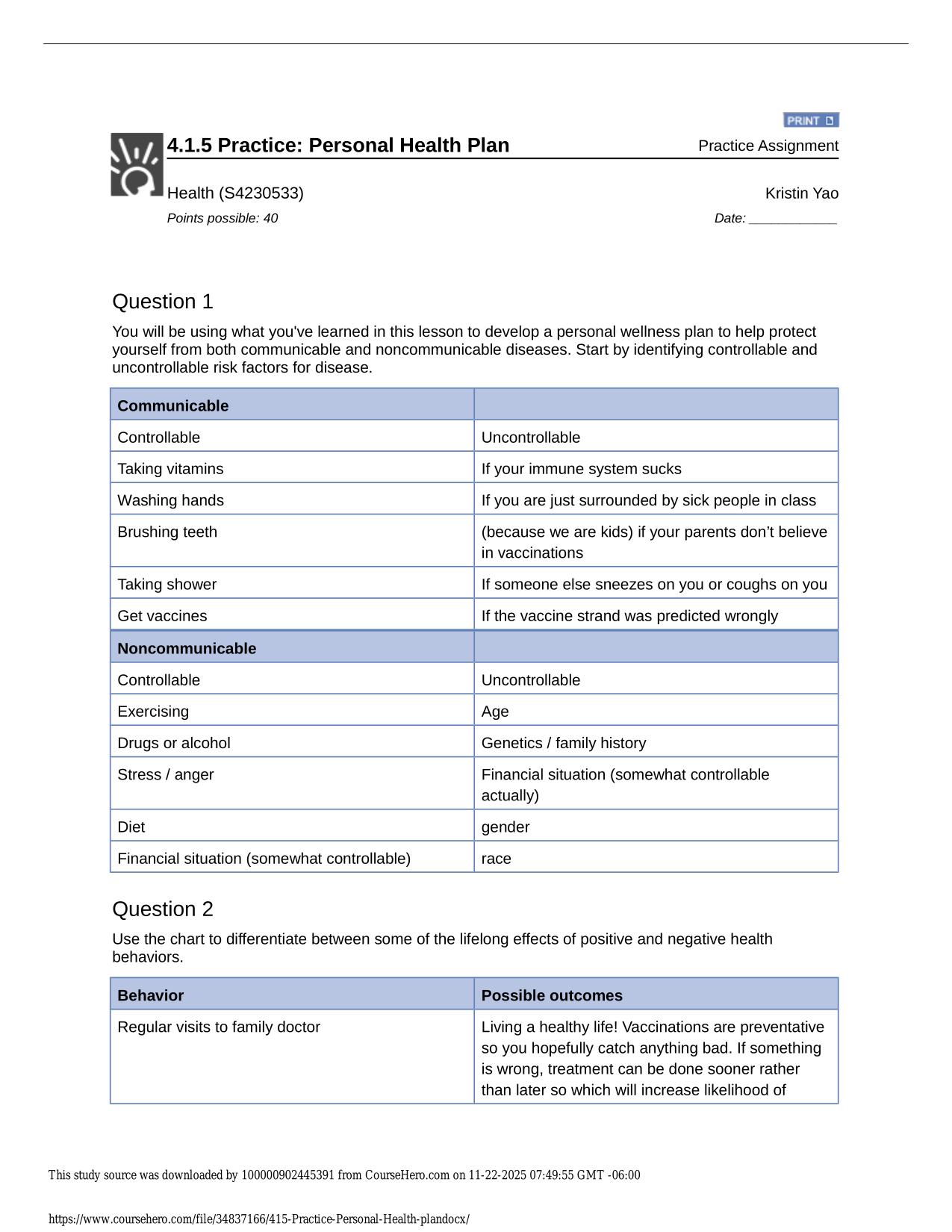

Questions are arranged to build from basic concepts to more advanced challenges, making the learning curve smoother and more methodical. You'll notice your self-assurance growing naturally as you learn thoroughly each level before moving to the next. This scaffolding approach prevents that overwhelmed feeling that often comes with jumping into complex topics too quickly. Many learners appreciate how this progression mirrors the way we naturally learn - building step by step from simple to sophisticated.

Who Is This For?

Designed for motivated learners working toward certification, licensure, or degree completion within the IACCP track. People appreciate how it keeps them organized during stressful preparation periods. The systematic approach helps maintain study momentum. Suitable for academic programs, tutoring sessions, and exam bootcamps focusing on IACCP and Exam (elaborations) fundamentals. Educators find it saves them preparation time while ensuring quality content. The material adapts well to different teaching environments.

Related Keywords

Detailed Study Description

Frequently Asked Questions

Document Information

| Uploaded on: | October 27, 2025 |

| Last updated: | November 17, 2025 |

| Number of pages: | 34 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | IACCP (QE) EXAM ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Which THREE persons or firms may be excluded from having to register under the Investment Advisers Act of 1940? (Choose three.) A. Accountants whose advisory services pertain solely to incidental financial planning. B. Persons or firms whose advice and reports are related solely to U.S. government securities. C. Publishers of generally circulated, bona fide newspapers or financial journals. D. Domestic banks and bank holding companies. - Answer -B. Persons or firms whose advice and reports are related solely to U.S. government securities. C. Publishers of generally circulated, bona fide newspapers or financia |

Seller Information

AdelineJean

User Reviews (0)

Exam (Elaborations)

$12.00

Bundle Deal! Get all 2 docs for just $13.00

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$12.00

| 0 sold

Discover More resources

Available in a Bundle

Inside The Document

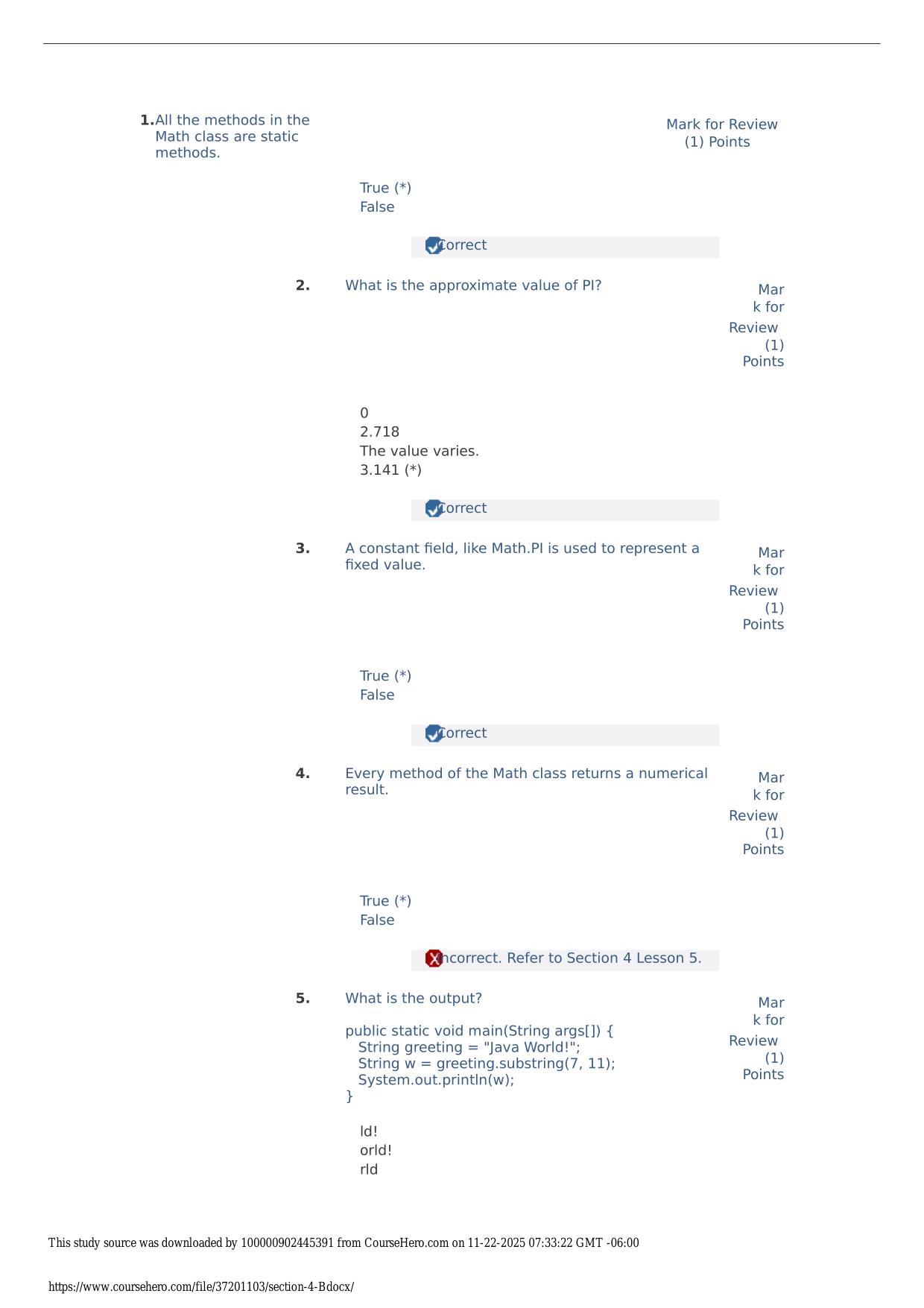

IACCP (QE) EXAM ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Which THREE persons or firms may be excluded from having to register under the Investment Advisers Act of 1940? (Choose three.) A. Accountants whose advisory services pertain solely to incidental financial planning. B. Persons or firms whose advice and reports are related solely to U.S. government securities. C. Publishers of generally circulated, bona fide newspapers or financial journals. D. Domestic banks and bank holding companies. - Answer -B. Persons or firms whose advice and reports are related solely to U.S. government securities. C. Publishers of generally circulated, bona fide newspapers or financial journals. D. Domestic banks and bank holding companies. Which activity is NOT mandated for investment advisers that store required records electronically? A. Providing the SEC with prompt access, retrieval, and reproduction. B. Maintaining copies of all electronically stored records using WORM format. C. Arranging and indexing records to provide easy access and retrieval. D. Developing procedures to preserve and maintain records. - Answer -B. Maintaining copies of all electronically stored records using WORM format. The Investment Advisers Act of 1940 defines the scope of the anti-fraud provisions as extending to: A. SEC-registered advisers and foreign advisers with a place of business in the U.S., whether registered or exempt. B. SEC-registered advisers and foreign advisers doing business in the Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com U.S., whether registered or exempt. C. SEC-registered investment advisers. D. All investment advisers, whether registered or exempt. - Answer -D. All investment advisers, whether registered or exempt. The fiduciary duty imposed on advisers under the Investment Advisers Act of 1940 can BEST be described as: A. providing equal disclosure to all clients. B. imposing an ERISA fiduciary standard. C. putting the client's interests ahead of the adviser's. D. acting in a custodial capacity. - Answer -C. putting the client's interests ahead of the adviser's. Which TWO qualify as a "security" under the Investment Advisers Act of 1940? (Choose two.) A. Commodity futures B. Limited partnership interests C. Fixed annuities D. Variable annuities - Answer -B. Limited partnership interests D. Variable annuities In performing due diligence on a potential solicitor, the investment adviser must ensure that the solicitor: A. is not subject to any statutory disqualification. B. is not acting as a solicitor for an unregistered adviser. C. has passed the Series 65 exam. D. is registered in appropriate states. - Answer -A. is not subject to any statutory disqualification. An SEC-registered investment adviser is NOT required to disclose "material" disciplinary information in its Form ADV Part 1 after: A. 5 years B. 10 years Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com

CourseHero & Studypool Unlocks

Get Unlocked CourseHero and Studypool documents files instantly to your email, simply by pasting your link and clicking "Unlock Now". Learn more on how to unlock here.