NC Personal Lines Correctly Answered Latest Update

Course:

NC Personal Lines

Institution:

NC Personal Lines

NC Personal Lines Correctly Answered Latest Update

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Document Information

| Uploaded on: | May 1, 2025 |

| Last updated: | May 12, 2025 |

| Number of pages: | 14 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | NC Personal Lines Correctly Answered Latest Update |

Seller Information

AdelineJean

User Reviews (0)

Exam (Elaborations)

$9.00

Bundle Deal! Get all 3 docs for just $13.00

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$9.00

| 0 sold

Discover More resources

Available in a Bundle

Package Deal for NC Personal Lines Correctly Answered Latest Update 2025-2026

Includes 3 Documents

$13.00

Content Preview

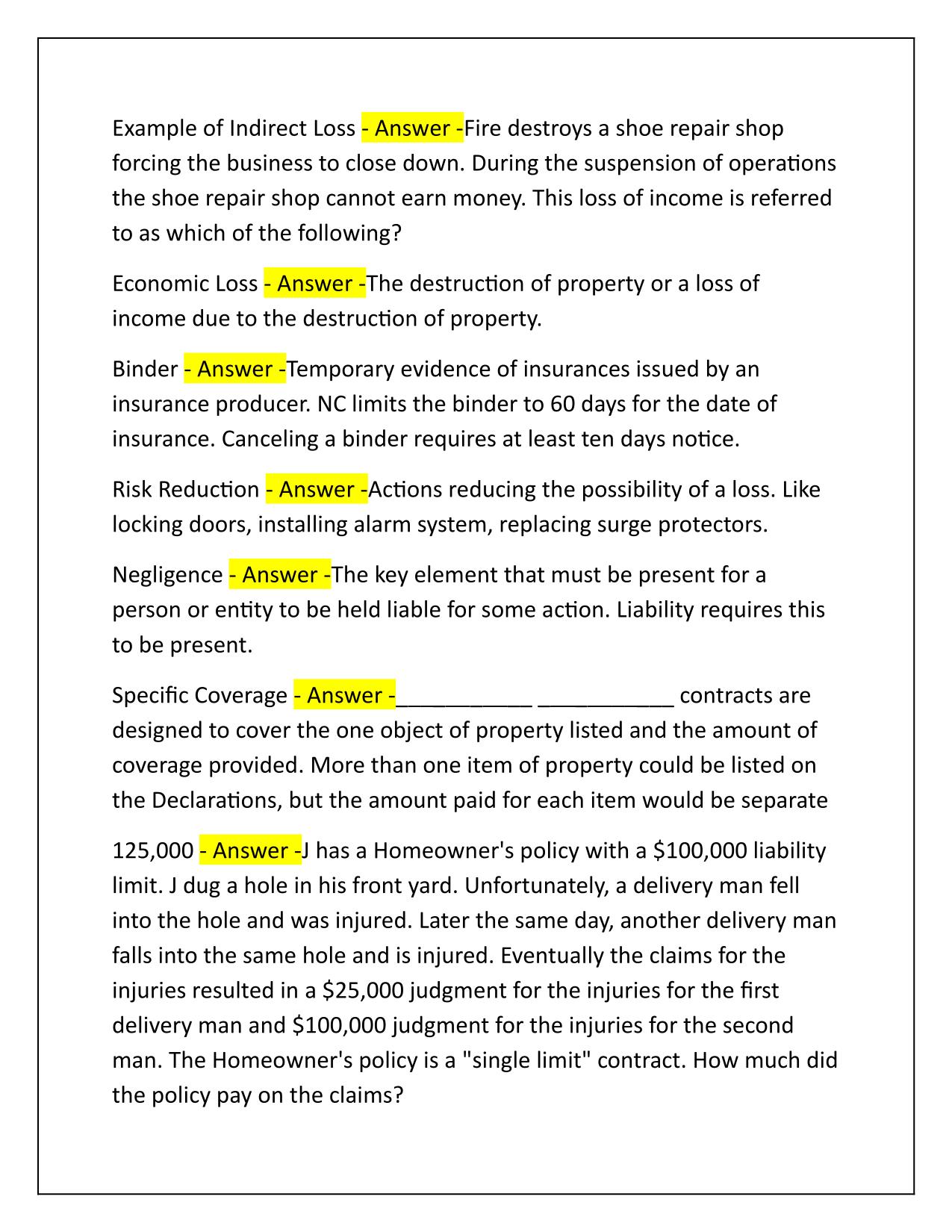

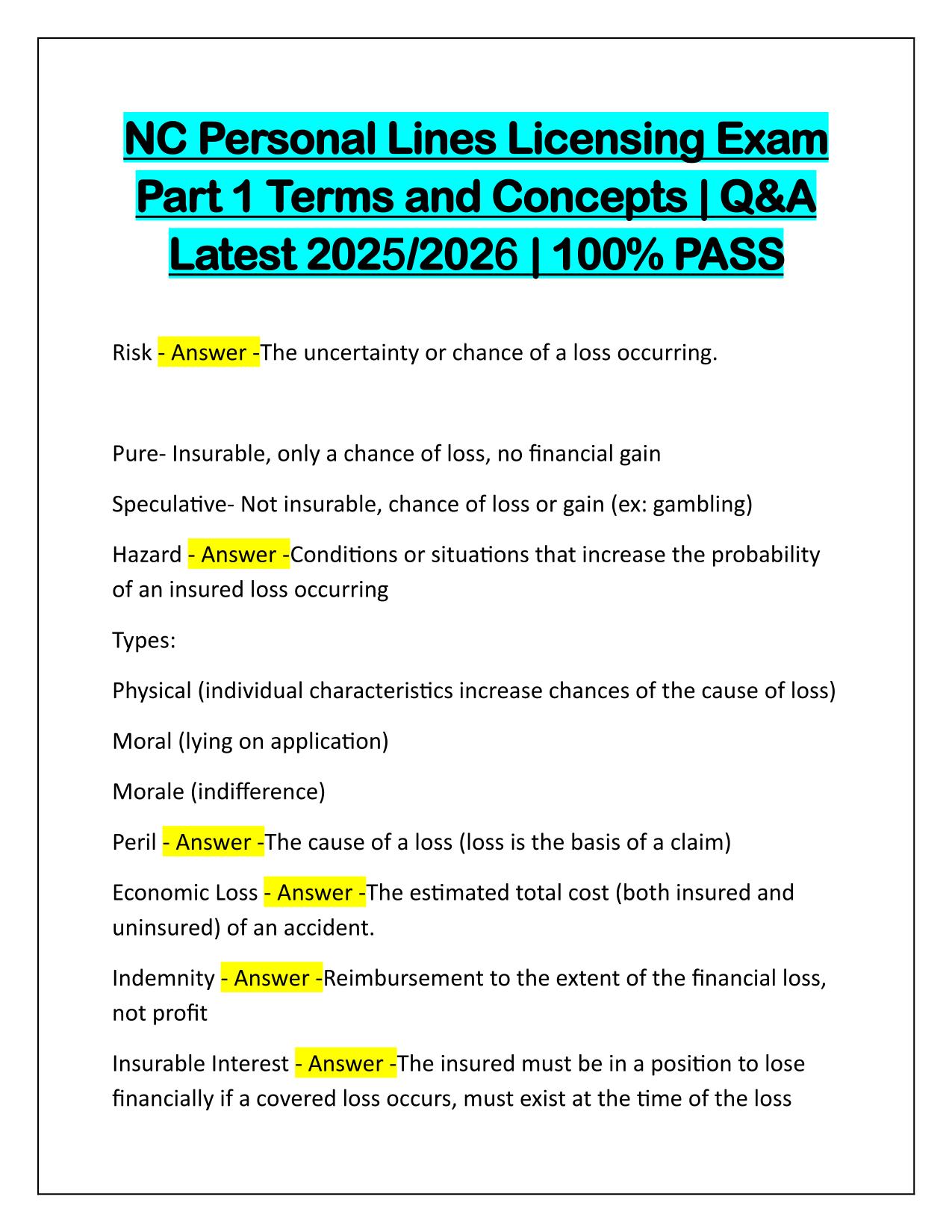

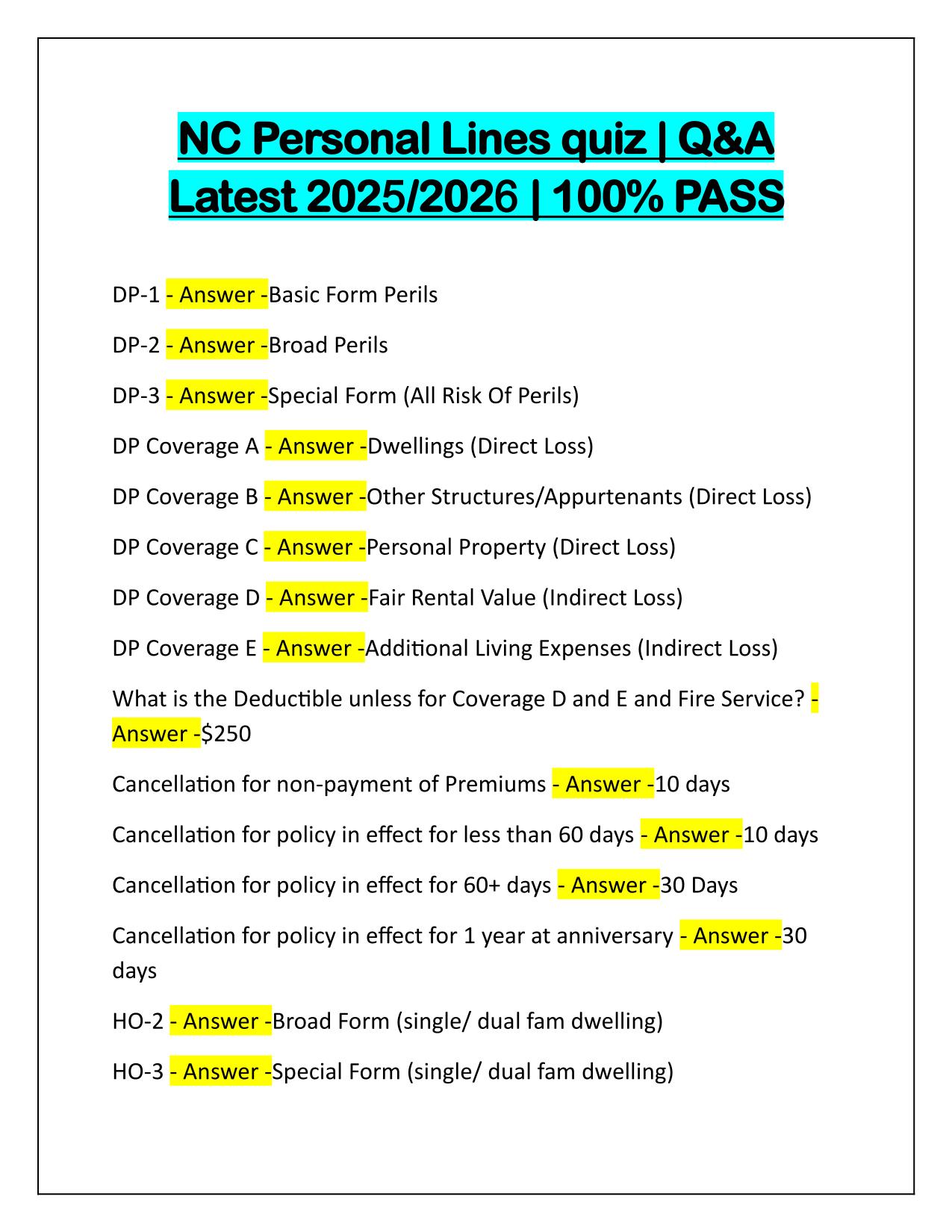

NC Personal Lines | Q&A Latest 2025/2026 | 100% PASS Example of Direct Loss - Answer -Loss due to fire destroying a building Risk Sharing - Answer -B and G agree to share the cost of replacing a basketball goal if it is damaged. In risk management terms this is __________ Replacement Cost - Answer -D has a property contract that agrees to pay her the full value of damaged personal property at the current cost without depreciation. This type of property loss valuation is known as: Risk - Answer -The chance of or uncertainty concerning a financial loss. In a split limits policy 50/100/50, the second number represents Answer -the total limit for two or more persons with bodily injury Insurable Interest - Answer -The ability to insure property due to ownership Declarations Page - Answer -Identifies the amount of premium to be paid, who or what is insured, and the amount of insurance coverage. Transferring Risk - Answer -Obtaining Insurance is a method of this _______. Insurers allow the insured to move the risk of loss from the insured to the insurance company for a fee (aka premium)