FINA 355 FINAL EXAM ACTUAL 2025/2026 WITH VERIFIED ANSWERS

Course:

FINA

Institution:

FINA

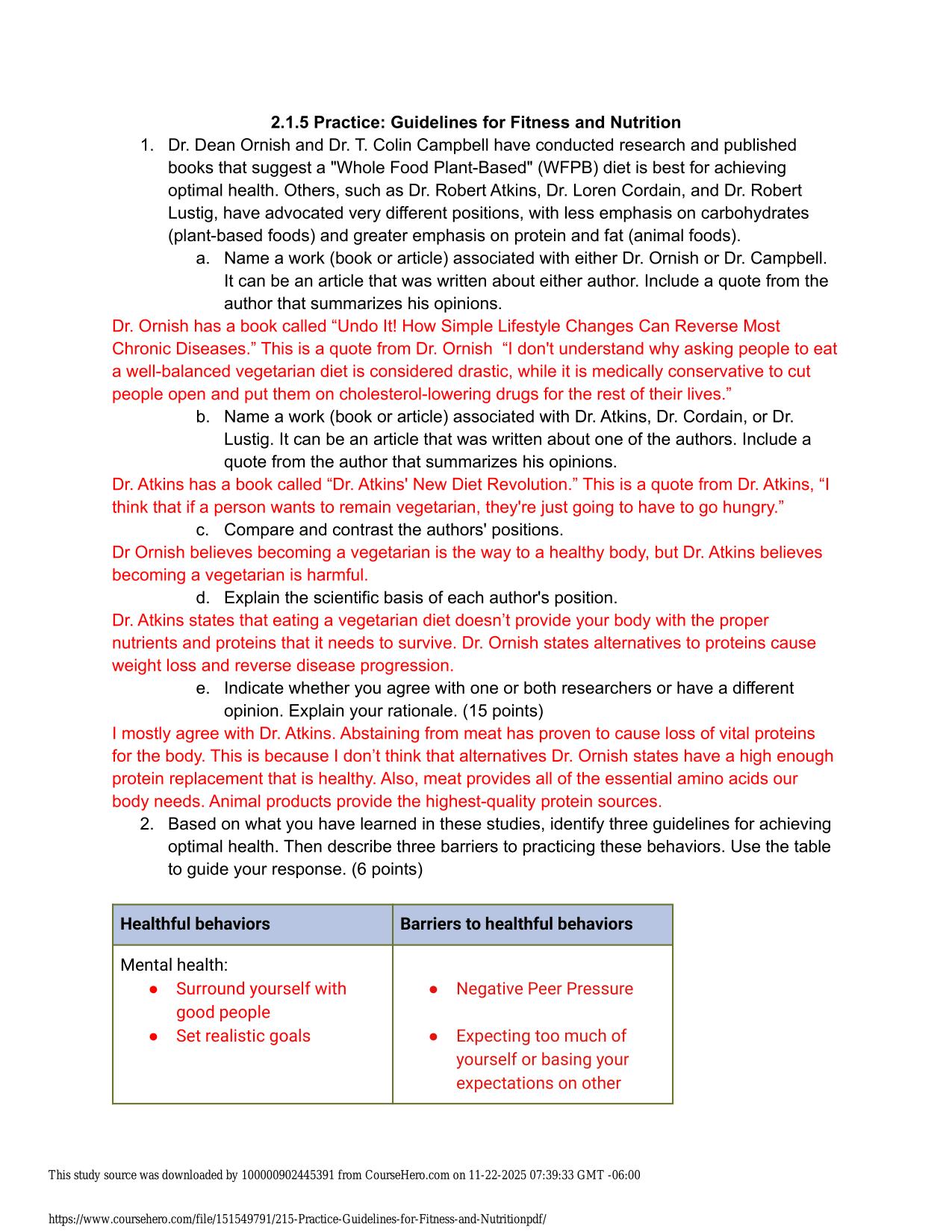

FINA 355 FINAL EXAM ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Which one of these represents the best means of increasing current shareholder value? - Answer -Increasing the current value of the overall firm Which form of business structure ...

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Overview

Each section begins with foundational ideas and gradually introduces more challenging concepts for balanced progression. This building-block approach ensures you have the necessary basics before tackling advanced material. Learners appreciate how each concept naturally flows from what came before, creating a cohesive learning experience. The thoughtful sequencing prevents knowledge gaps that can undermine your assurance and performance.

Who Is This For?

Recommended for any student or trainee who needs systematic guidance and verified practice material for modern FINA assessments. Many find it reduces their pre-exam anxiety. The reliable content helps users feel more secure in their knowledge.

Related Keywords

Detailed Study Description

Frequently Asked Questions

Document Information

| Uploaded on: | October 31, 2025 |

| Last updated: | November 25, 2025 |

| Number of pages: | 145 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | FINA 355 FINAL EXAM ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Which one of these represents the best means of increasing current shareholder value? - Answer -Increasing the current value of the overall firm Which form of business structure typically has the greatest potential for agency problems? - Answer -Corporation The basic regulatory framework for the public trading of securities in the United States was provided by the: - Answer -Securities Act of 1933 and the Securities Exchange Act of 1934. |

Seller Information

AdelineJean

This YouTube preview covers the main topics included in the document, such as chapters, practice questions, solved problems or summaries.

User Reviews (0)

Exam (Elaborations)

$10.00

Bundle Deal! Get all 7 docs for just $22.00

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$10.00

| 0 sold

Discover More resources

Available in a Bundle

Inside The Document

FINA 355 FINAL EXAM ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Which one of these represents the best means of increasing current shareholder value? - Answer -Increasing the current value of the overall firm Which form of business structure typically has the greatest potential for agency problems? - Answer -Corporation The basic regulatory framework for the public trading of securities in the United States was provided by the: - Answer -Securities Act of 1933 and the Securities Exchange Act of 1934. Muffy's Muffins had net income of $2,535. The firm retains 70 percent of net income. During the year, the company sold $475 in common stock. What was the cash flow to shareholders? - Answer -Cash flow to stockholders = (1 − .70) × $2,535 − 475 = $286 Red Barchetta Co. paid $27,500 in dividends and $28,311 in interest over the past year. During the year, net working capital increased from $13,506 to $18,219. The company purchased $42,000 in fixed assets and had a depreciation expense of $16,805. During the year, the company issued $25,000 in new equity and paid off $21,000 in longterm debt. What was the company's cash flow from assets? - Answer -Cash flow from assets = ($28,311 + 21,000) + ($27,500 − 25,000) = $51,811 Free cash flow is: - Answer -cash that the firm can distribute to creditors and stockholders. Ratios that measure a firm's financial leverage are known as ________ Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com ratios. - Answer -long-term solvency A firm wants a sustainable growth rate of 3.23 percent while maintaining a dividend payout ratio of 29 percent and a profit margin of 8 percent. The firm has a capital intensity ratio of 2. What is the debtequity ratio that is required to achieve the firm's desired rate of growth? - Answer -Sustainable growth rate = .0323 = [ROE × (1 - .29)]/{1 - [ROE × (1 - .29)]} ROE = .04407 ROE = .04407 = .08 × (1/2) × Equity multiplier Equity multiplier = 1.10 Debt-equity ratio = 1.10 - 1 = .10 times A firm has a return on equity of 19 percent. The total asset turnover is 1.8 and the profit margin is 7 percent. The total equity is $3,700. What is the net income? - Answer -Net income = .19 × $3,700 = $703 Mario's Home Systems has sales of $2,790, costs of goods sold of $2,130, inventory of $498, and accounts receivable of $427. How many days, on average, does it take Mario's to sell its inventory? - Answer -Inventory turnover = $2,130/$498 = 4.2771 Days' sales in inventory = 365 days/4.2771 = 85.34 days What effect will an increase in the discount rate have on the present value of a project that has an initial cash outflow followed by five years of cash inflows? - Answer -The PV will decrease. Beatrice invests $1,420 in an account that pays 4 percent simple interest. How much more could she have earned over a 5-year period if the interest had been compounded annually? - Answer -Balance Year 5 with simple interest = $1,420 + ($1,420 × 0.04 × 5) = $1,704.00 Balance Year 5 with compound interest = $1,420 × 1.04^5 = $1,727.65 Additional interest = $1,727.65 - 1,704.00 = $23.65 Your parents are giving you $170 a month for 4 years while you are in Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com

CourseHero & Studypool Unlocks

Get Unlocked CourseHero and Studypool documents files instantly to your email, simply by pasting your link and clicking "Unlock Now". Learn more on how to unlock here.