FINA5320 EXAM 3 ACTUAL 2025/2026 CORRECTLY ANSWERED

Course:

FINA

Institution:

FINA

FINA5320 EXAM 3 ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Which one of these measure the interrelationship between two securities? - Answer -Covariance Which one of these measures the squared deviations of actual returns from expected retur...

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Overview

The document highlights key principles that repeatedly appear on exam sessions, reinforcing crucial knowledge. You're always focusing on high-yield content that has the biggest impact on your score. This strategic emphasis is perfect for busy learners who need to make the most of limited study time. Many students find this focus helps them prioritize their efforts where they'll get the greatest return.

Who Is This For?

Ideal for motivated learners who want both conceptual clarity and hands-on question practice centered around FINA5320 3 ACTUAL / CORRECTLY ANSWERED. Many find it strikes the right balance between theory and application. The integrated approach helps knowledge stick better.

Related Keywords

Detailed Study Description

Frequently Asked Questions

Document Information

| Uploaded on: | October 31, 2025 |

| Last updated: | November 25, 2025 |

| Number of pages: | 15 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | FINA5320 EXAM 3 ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Which one of these measure the interrelationship between two securities? - Answer -Covariance Which one of these measures the squared deviations of actual returns from expected returns? - Answer -Variance |

Seller Information

AdelineJean

This YouTube preview covers the main topics included in the document, such as chapters, practice questions, solved problems or summaries.

User Reviews (0)

Exam (Elaborations)

$8.50

Bundle Deal! Get all 7 docs for just $22.00

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$8.50

| 0 sold

Discover More resources

Available in a Bundle

Inside The Document

FINA5320 EXAM 3 ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Which one of these measure the interrelationship between two securities? - Answer -Covariance Which one of these measures the squared deviations of actual returns from expected returns? - Answer -Variance The return on one stock will exceed the stock's average return when the second stock has a return that is less than its average. - Answer -A negative covariance between the returns of Stock A and Stock B indicates that: covarianceAB divided the product of the standard deviations of A and B - Answer -The correlation between stocks A and B is equal to the: a strong positive correlation - Answer -You plotted the monthly rate of return for two securities against time for the past 48 months. If the pattern of the movements of these two sets of returns rose and fell together the majority, but not all, of the time, then the securities have Is limited by the returns on the individual securities within the portfolio. - Answer -The expected return on a portfolio ____. market value of the total shares held in each stock - Answer -When computing the expected return on a portfolio of stocks the portfolio weights are based on the may be less than the variance of the least risky stock in the portfolio - Answer -If a stock portfolio is well diversified, then the portfolio variance: Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com Portfolio Weight - Answer -The percentage of a portfolio's total value invested in a particular asset is called the asset's ___. capital market line that shows that investors will invest in a combination of the riskless asset and the tangency portfolio. - Answer -The combination of the efficient set of portfolios with a riskless lending and borrowing rate results in the: The Capital Market Line is the pricing relationship between ____. - Answer -The Capital Market Line is the pricing relationship between ____. Both the rate of return and the standard deviation of a portfolio can be changed by changing the portfolio weights. - Answer -Which one of these statements is correct regarding a portfolio of two risky securities Unsystematic risks - Answer -Well diversified portfolios have negligible Be the same portfolio of risky assets chosen by all investors. Have the securities weighted by their market value proportions.Be a diversified portfolio. - Answer -If investors possess homogeneous expectations over all assets in the market portfolio, when risk-less lending and borrowing is allowed, the market portfolio is defined to ___. Unsystematic risks - Answer -can be eliminated through a portfolio diversification 30 - Answer -The majority of the benefits from a portfolio diversification can generally be achieved with just ____ diverse securities. A decrease in the portfolio standard deviation - Answer -Which one of the following would tend to indicate that a portfolio is being effectively diversified? A group of assets, such as stocks and bonds, held as a collective unit by Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com

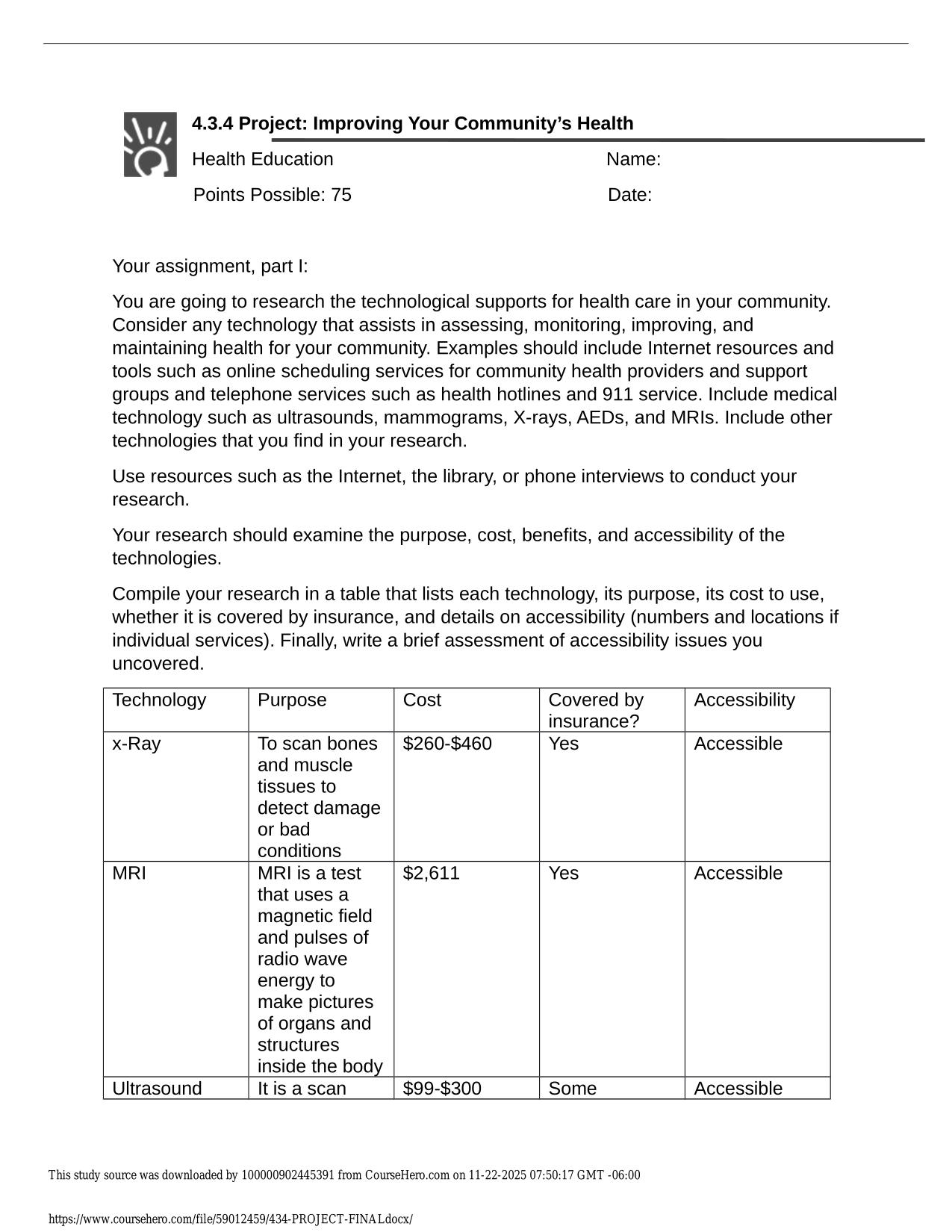

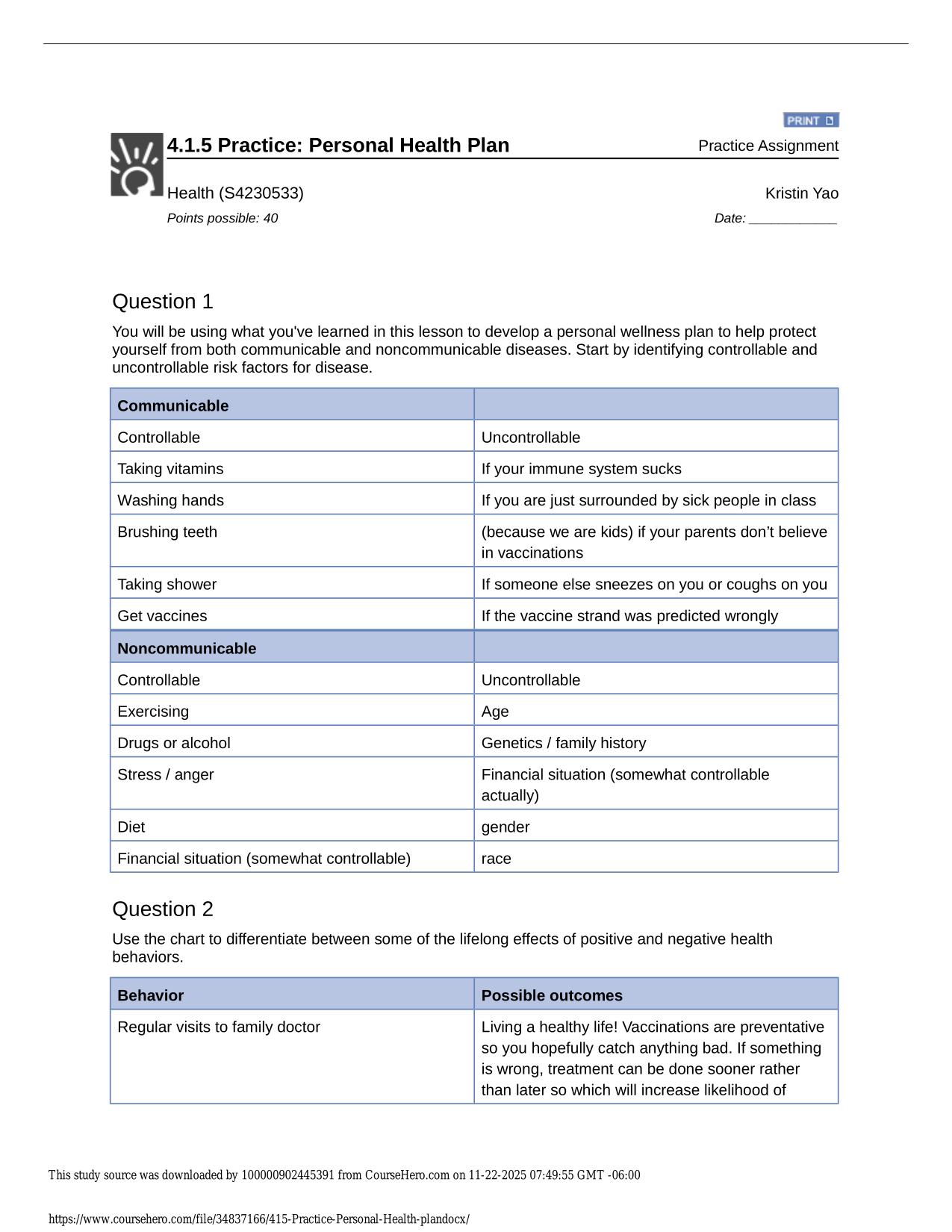

CourseHero & Studypool Unlocks

Get Unlocked CourseHero and Studypool documents files instantly to your email, simply by pasting your link and clicking "Unlock Now". Learn more on how to unlock here.