FINA EXAM 3 ACTUAL 2025/2026 CORRECTLY ANSWERED

Course:

FINA

Institution:

FINA

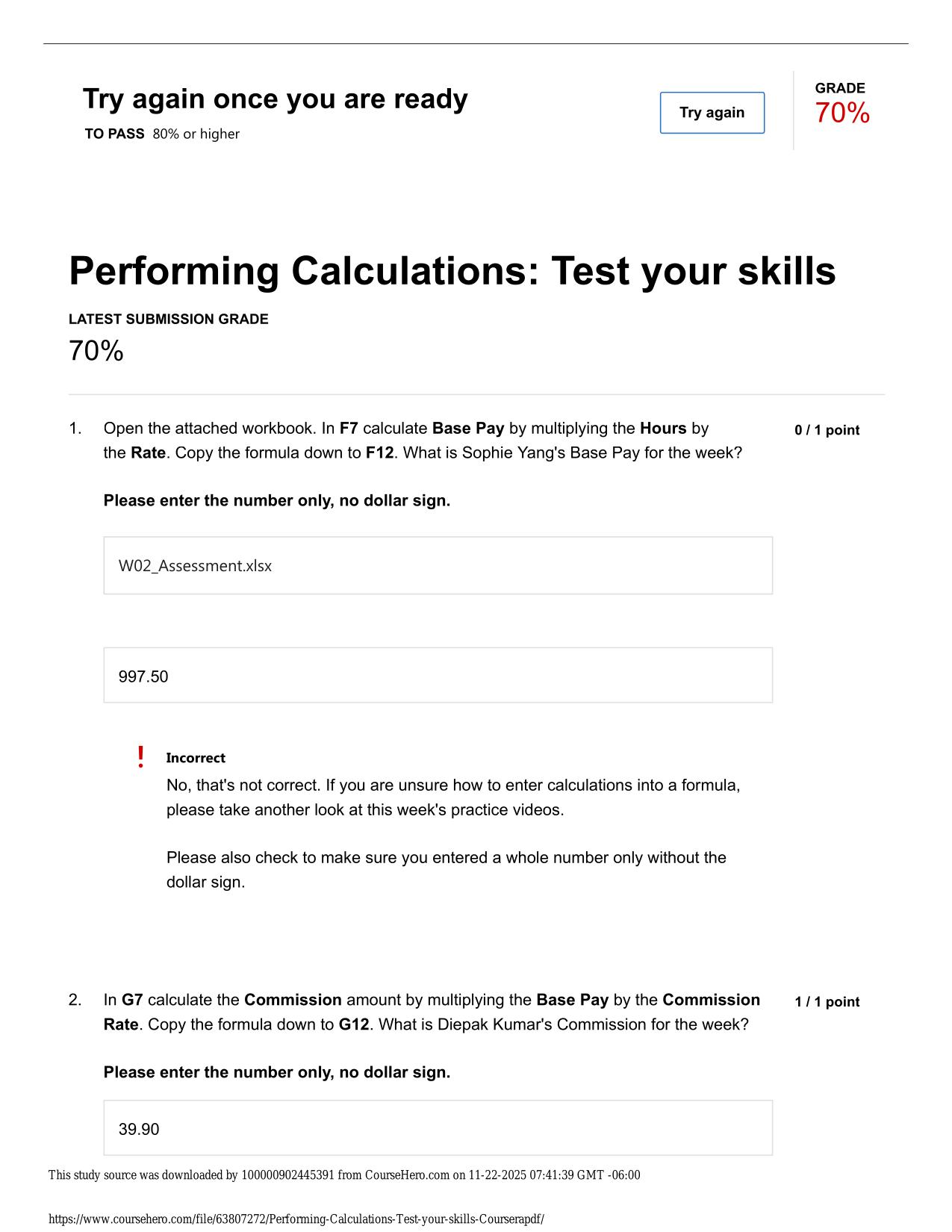

FINA EXAM 3 ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Compared to other investment options, we can safely say that investing in stocks A) has equal risk. B) has greater risk C) has less risk. D) is not worth the risk - Answer -B) has greate...

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Overview

Sections are arranged by topic to streamline revision and to help you identify areas that need more practice. This organization is a lifesaver when you're short on time and need to focus on your weakest areas quickly. Students love being able to jump straight to the topics giving them trouble without wading through unrelated material. The clear structure makes it easy to create focused study sessions that address your specific needs and knowledge gaps.

Who Is This For?

A practical option for those preparing for school assessments, standardized tests, or professional exams in FINA. The material has proven effective across different educational contexts. Users appreciate its straightforward, no-nonsense approach to test preparation.

Related Keywords

Detailed Study Description

Frequently Asked Questions

Document Information

| Uploaded on: | October 31, 2025 |

| Last updated: | December 10, 2025 |

| Number of pages: | 54 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | FINA EXAM 3 ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Compared to other investment options, we can safely say that investing in stocks A) has equal risk. B) has greater risk C) has less risk. D) is not worth the risk - Answer -B) has greater risk Which of the following are passed on to fund share holders through 12b-1 fees? A) Commissions B) Advertising expenses C) Promotional feesNeed assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com D) Only B and C E) All of the above - Answer -D) Only B and C |

Seller Information

AdelineJean

This YouTube preview covers the main topics included in the document, such as chapters, practice questions, solved problems or summaries.

User Reviews (0)

Exam (Elaborations)

$10.00

Bundle Deal! Get all 7 docs for just $22.00

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$10.00

| 0 sold

Discover More resources

Available in a Bundle

Inside The Document

FINA EXAM 3 ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS Compared to other investment options, we can safely say that investing in stocks A) has equal risk. B) has greater risk C) has less risk. D) is not worth the risk - Answer -B) has greater risk Which of the following are passed on to fund share holders through 12b-1 fees? A) Commissions B) Advertising expenses C) Promotional fees D) Only B and C E) All of the above - Answer -D) Only B and C Which of the following will affect your capital gains liability? A) Turnover ratio B) Changes in net asset value C) Expense ratio D) All of the above are correct. E) Only A and B are correct. - Answer -E) Only A and B are correct. The ________ is the value of the mutual fund's holdings, minus any debt, divided by the number of shares outstanding. A) net worth B) market value C) tangible value Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com D) net asset value E) none of the above - Answer -D) net asset value Total returns on mutual funds can be calculated by adding dividends distributed, capital gains distributed, and ________ and dividing this sum by the beginning NAV. A) beginning NAV - ending NAV B) ending NAV - beginning NAV C) dividends undistributed + capital gains undistributed D) beginning NAV + ending NAV E) ending NAV + beginning NAV - Answer -B) ending NAV - beginning NAV What is the total return for a mutual fund with the following characteristics? beginning NAV = $55.82 ending NAV = $70.52 dividends distributed = $2.25 capital gains distributed = $3.50 A) 29.71% B) 30.82% C) 32.26% D) 36.64% - Answer -D) 36.64% Zippo Mutual Fund is one of your best performers. It just announced a year-end distribution of $2.50 per share in capital gains and $4.25 in dividends. Assuming the NAV increased from $31.50 to $43.75, calculate your total annual return. A) 60.32% B) 46.87% C) 26.95% D) 24.53% - Answer -A) 60.32% Suppose that the current value of all of a mutual fund's holdings is determined to be $750 million. The fund's liabilities are $125 million and it grew at 20% from last year. It currently has 45 million shares outstanding. What is the fund's NAV? A) $12.00 per share Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com

CourseHero & Studypool Unlocks

Get Unlocked CourseHero and Studypool documents files instantly to your email, simply by pasting your link and clicking "Unlock Now". Learn more on how to unlock here.